Home

Transpac ocean rates climbing on China-US rebound – May 20, 2025 Update

The Freightos Weekly Update keeps you informed on international freight with key economic data, demand trends, and rate insights.

May 20, 2025

Blog

Weekly highlights

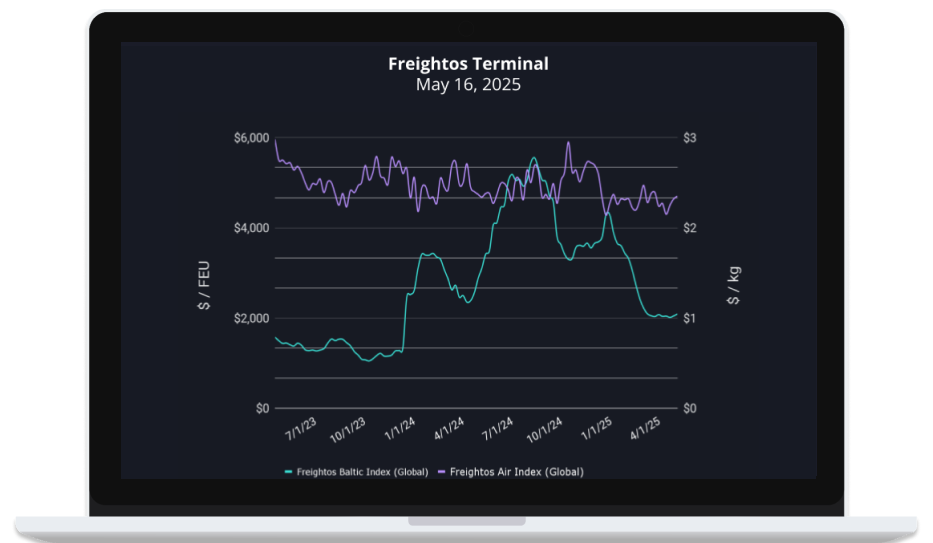

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) increased 3% to $2,462/FEU.

- Asia-US East Coast prices (FBX03 Weekly) increased 3% to $3,520/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 3% to $2,459/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 1% to $2,979/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices increased 4% to $5.50/kg.

- China – N. Europe weekly prices increased 1% to $3.53/kg.

- N. Europe – N. America weekly prices fell 1% to $1.88/kg.

Analysis

The clock has started for the China-US tariff deescalation that expires August 14th. It is ticking even faster for US importers sourcing from a long list of US trading partners for whom a reciprocal tariff pause – likewise initiated to allow time for trade deal negotiations – will end on July 9th.

So far though, only the UK has come to a tentative deal with the US, with the US’s insistence on keeping its 25% auto tariff in place reportedly a sticking point in negotiations with the EU, S. Korea and Japan. President Trump recently said he doesn’t expect to come to agreements with all of these countries in time and will therefore likely unilaterally apply tariffs instead, though it is unclear if those levies will be back to the levels announced in April or not.

And to complicate matters further, it is also unclear if those July and August deadlines mean goods need to be loaded at origins by those dates – as was the case with the April 9th tariff deadline – or that goods must arrive in the US by then. The latter would significantly shorten these lower-tariff windows. Ocean shipments from the Far East would have to move in the next week or two to arrive before July 9th.

Join 50k+ subscribers who get our free freight weekly update

“*” indicates required fields

gform.initializeOnLoaded( function() {gformInitSpinner( 17, ‘https://www.freightos.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(‘#gform_ajax_frame_17’).on(‘load’,function(){var contents = jQuery(this).contents().find(‘*’).html();var is_postback = contents.indexOf(‘GF_AJAX_POSTBACK’) >= 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_17’);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_17’).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_17’).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_17’).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_17’).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_17’).val();gformInitSpinner( 17, ‘https://www.freightos.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(document).trigger(‘gform_page_loaded’, [17, current_page]);window[‘gf_submitting_17’] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}jQuery(‘#gform_wrapper_17’).replaceWith(confirmation_content);jQuery(document).trigger(‘gform_confirmation_loaded’, [17]);window[‘gf_submitting_17’] = false;wp.a11y.speak(jQuery(‘#gform_confirmation_message_17’).text());}else{jQuery(‘#gform_17’).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(“gform_pre_post_render”, [{ formId: “17”, currentPage: “current_page”, abort: function() { this.preventDefault(); } }]); if (event && event.defaultPrevented) { return; } const gformWrapperDiv = document.getElementById( “gform_wrapper_17” ); if ( gformWrapperDiv ) { const visibilitySpan = document.createElement( “span” ); visibilitySpan.id = “gform_visibility_test_17”; gformWrapperDiv.insertAdjacentElement( “afterend”, visibilitySpan ); } const visibilityTestDiv = document.getElementById( “gform_visibility_test_17” ); let postRenderFired = false; function triggerPostRender() { if ( postRenderFired ) { return; } postRenderFired = true; gform.core.triggerPostRenderEvents( 17, current_page ); if ( visibilityTestDiv ) { visibilityTestDiv.parentNode.removeChild( visibilityTestDiv ); } } function debounce( func, wait, immediate ) { var timeout; return function() { var context = this, args = arguments; var later = function() { timeout = null; if ( !immediate ) func.apply( context, args ); }; var callNow = immediate && !timeout; clearTimeout( timeout ); timeout = setTimeout( later, wait ); if ( callNow ) func.apply( context, args ); }; } const debouncedTriggerPostRender = debounce( function() { triggerPostRender(); }, 200 ); if ( visibilityTestDiv && visibilityTestDiv.offsetParent === null ) { const observer = new MutationObserver( ( mutations ) => { mutations.forEach( ( mutation ) => { if ( mutation.type === ‘attributes’ && visibilityTestDiv.offsetParent !== null ) { debouncedTriggerPostRender(); observer.disconnect(); } }); }); observer.observe( document.body, { attributes: true, childList: false, subtree: true, attributeFilter: [ ‘style’, ‘class’ ], }); } else { triggerPostRender(); } } );} );

jQuery( document ).ready(function() {

setTimeout(() => { Cookies.get(“utm_source”) ? jQuery(‘#input_17_4’).val(decodeURIComponent(Cookies.get(“utm_source”) ?? ”)) : ”;

Cookies.get(“utm_medium”) ? jQuery(‘#input_17_5’).val(decodeURIComponent(Cookies.get(“utm_medium”) ?? ”)) : ”;

Cookies.get(“utm_content”) ? jQuery(‘#input_17_6’).val(decodeURIComponent(Cookies.get(“utm_content”) ?? ”)) : ”;

Cookies.get(“utm_campaign”) ? jQuery(‘#input_17_7’).val(decodeURIComponent(Cookies.get(“utm_campaign”) ?? ”)) : ”;

Cookies.get(“handl_landing_page”) ? jQuery(‘#input_17_8’).val(decodeURIComponent(Cookies.get(“handl_landing_page”) ?? ”)) : ”;

}, 1000);

})

The May 12th China-US deescalation is driving a big bump in China-US ocean demand after a significant drop in volumes since the US’s 145% tariffs on China took effect in early April.

In response, carriers are introducing mid-month GRIs of $1,000 – $3,000/FEU with similar increases planned for June 1st and 15th, aiming to push rates up to as high as $8,000/FEU in the next few weeks. If successful, rate levels would be about on part with the Asia – US West Coast 2024 high reached last July. Daily transpacific rates as of Monday have already increased about $1,000/FEU to the East Coast and $400/FEU to the West Coast to about $4,400/FEU and $2,800/FEU respectively.

As demand rebounds, carriers are rushing to restore blanked sailings and suspended services cancelled during the April lull. But many transpacific vessels and containers were shifted to other lanes in the interim and are now out of position, leading to some capacity and equipment shortages in China as bookings pick back up.

This tight capacity is also contributing – together with congestion and delays of several days at some Chinese container hubs resulting from the increase in demand as well as some bad weather – to climbing container prices. Given the approaching deadlines, we may also see stronger demand and more upward pressure on rates to the West Coast than to the East Coast as shippers opt for shorter transit times.

With so much ocean freight already frontloaded in the past six months and the 30% minimum China tariff still a substantial cost hike for US importers, some experts think demand and rates will rebound but not surge ahead of the August deadline – even if this week does mark an early start to this year’s peak season that may end earlier than usual as well.

Meanwhile, Jonathan Gold, VP of Supply Chain at the National Retail Federation, told us in our update webinar yesterday that he thinks importers will resume with significant frontloading both out of concern that tariffs on China could climb higher again and because many seasonal goods just couldn’t be ordered and moved yet – meaning that peak season has started and could be a strong one into August.

By this time last year, Asia-Europe’s ocean peak season had already started as shippers tried to adapt to longer, Red Sea-diverted voyages by placing their peak season orders a couple months early. But despite Red Sea diversions still in place, Asia – Europe demand has yet to pick up this time around.

In any case, carriers have announced GRIs for June that aim to push rates up to around $3,200/FEU to Europe and $4,500/FEU to the Mediterranean for around a $1,000/FEU gain – significantly lower than the $6,000 – $7,000/FEU level seen last June. This disparity may reflect the significant challenge that capacity growth is posing for carriers on this lane. The significant congestion that has persisted at many European hubs for weeks now has not supported rate increases yet, though reports that some Asia-Europe capacity is now shifting to the transpacific could help reduce capacity and push these GRIs through.

A significant amount of freighter capacity has left the transpacific air cargo market since the US suspended de minimis eligibility for Chinese goods and e-commerce volumes moving by air cargo on this lane have dropped. With this shift concentrated in the chartered freighter market though, spot rates have for now remained elevated. Freightos Air Index China-US rates of $5.50/kg last week were level with early April prices. That formerly transpacific freighter capacity may be starting to move to other lanes though, which could start impacting rate levels for these markets as well.

Put the Data in Data-Backed Decision Making

Freightos Terminal helps tens of thousands of freight pros stay informed across all their ports and lanes

The post Transpac ocean rates climbing on China-US rebound – May 20, 2025 Update appeared first on Freightos.