Trucking News and Briefs for Friday, June 14th 2024:

FMCSA addresses small-carrier concerns by finalizing a 25% increase in UCR fees

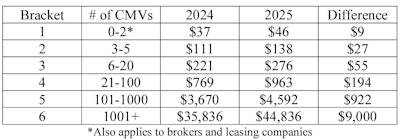

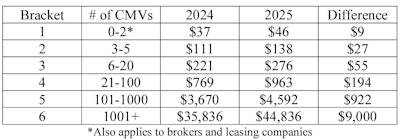

On Monday, June 17, the Federal Motor Carrier Safety Administration published a final rule which will increase fees for the Unified Carrier Registration Plan and Agreement (UCR) for the registration year 2025 and beyond.

In January , the agency proposed to increase registration fees by 25% for the 2025 year. This means that a single truck owner-operator with authority will have to spend an extra $9 per year. Fleets with over 1,000 trucks will have to pay $9,000 more in 2024 than they did.

FMCSA noted that the increase comes after a decrease in fees of 37.3% on average over the past two years.

The FMCSA will increase UCR Plan fees by 25% in 2025 to compensate for the revenue shortfall after two years of decreasing fees.

The FMCSA will increase UCR Plan fees by 25% in 2025 to compensate for the revenue shortfall after two years of decreasing fees.

The board of the plan makes recommendations to the Secretary for Transportation regarding fee adjustments when revenue collections are insufficient or exceed the amount authorized by law. Federal law requires fee adjustments. The fee increases will generate revenues of $13 millions that will allow the UCR Plan, FMCSA said, to cover the shortfalls resulting from the decreases in fees in the two previous registration years.

The agency noted that several commenters on its January proposal asked for clarifications about the fees, while others called the adjustment “unwarranted or unexpected.”

The FMCSA said that the fees are used for motor carrier safety enforcement and programs by participating states. It added that it believes this upward adjustment, the first since 2010, “is within a range of reasonableness.”

“Any amount less than these adjustments would hinder the proper operation of motor carrier safety program, enforcement or administration of the UCR Plan, and UCR Agreement,” FMCSA stated.

The agency also addressed concerns regarding the impact of fee increases on small business.

The agency stated that even for small carriers the fee increase would amount to a minimal portion of their income. Operators in the smallest bracket, with 1-2 trucks, will pay $9 more, while those in the next bracket, with 3-5 trucks, will pay $27. The FMCSA said that the fee increase would be a small percentage of revenue and will not impact the viability or longevity of motor carrier operations.

[ Related to FMCSA proposes a 25% increase for UCR fees]

The trucking conditions improved significantly in April

According to the latest report by FTR , the conditions for trucking companies were much better in April than in March.

FTR’s Trucking Conditions Index showed a more hospitable atmosphere for carriers in April. However, it remained negative at a reading -1.95. This is up from -7.25. This is the best reading for the TCI since January when it was at -1.41.

The firm noted that both freight rates and financing cost were less negative in April and that freight volume improved throughout the month.

Avery Vise is FTR’s Vice President of Trucking. “Better days for trucking companies are in sight, but the market must still work through the difficult combination of too much freight capacity and sluggish demand,” he said. “The May trucking payroll jobs figures offered some encouragement that the transition is underway. However, a healthier situation will require continued rightsizing capacity and stronger volumes. We do not expect carriers to experience consistently favorable market conditions until early next year.

The index hasn’t been positive since early 2022, and it will likely be mostly mildly positive for the rest of this year. However, FTR says that it could see some positive readings as the index moves closer to neutral.

Vise noted that the trucking industry employment in May was contrary to the overall economic trend. The Bureau of Labor Statistics monthly report shows that trucking lost approximately 5,400 jobs in May, while the economy as a whole gained 272,000. Despite the decline in trucking employment, the entire transportation industry gained nearly 11,000 new jobs in May.

According to Motive’s Monthly Economic Report June 1,229 trucking firms left the market in May. This represents a slight rise from March, but is 67% less than January. The firm reported that May was the third consecutive month where fewer than 2,001 trucking companies left the market. This indicates that the market is stabilizing and moving towards positive growth. Motive also noted that 8,466 new carriers registered in May, marking the fourth consecutive month of more than 8,000 new entries.

[ Related: Understanding fixed and variable costs is key to success for owner-operator]

Idaho asks drivers in construction zones to slow down

Due to recent unsafe driving behavior, the Idaho Transportation Department (ITD), is asking drivers to slow-down and be on the lookout for construction crews along State Highway55 south of Horseshoe Bend.

“There have also been a few close calls where drivers ignored the flagging crews or the posted speed limit in the work zone,” said Project Manager J.D. Lewelling said. “Safety is the highest priority for us, so we need drivers to pay attention.”

The ongoing work includes milling the road and resurfacing it for a more comfortable driving experience. As part of the safety improvements, guardrails will be replaced as necessary throughout the project area.

Construction is primarily focused on the highway, which runs approximately four miles north from Avimor and ends just south of Payette River Bridge at Horseshoe Bend. The project includes the construction of a bridge that will carry both vehicle and pedestrian traffic over SH-55, at the north end Avimor. Avimor is funding this work.

Construction is expected to be completed by this fall.

Read More

The FMCSA will increase UCR Plan fees by 25% in 2025 to compensate for the revenue shortfall after two years of decreasing fees.

The FMCSA will increase UCR Plan fees by 25% in 2025 to compensate for the revenue shortfall after two years of decreasing fees.