Study highlights cost of underutilized truckload space and inefficiencies in LTL shipping

From higher operational costs to increased environmental impact, understanding and addressing aspects to leverage truckload space is crucial in today’s freight market.

A study by Flock Freight and Drive Research investigated costs associated with underutilized truckload space and inefficiencies of less-than-truckload shipping. It surveyed 1,000 transportation decision-makers from different industries, including retail, industrial machinery/equipment, building materials, and plastics/paper/packaging, among others.

According to the report, 43% of truckloads moved partially empty in 2023, with an average of 29 linear feet of unused deck space. This inefficiency means that one of every four truckloads were moving completely empty, posing a major economic and environmental issue.

The report indicated that in 2023, with the average less-than-truckload cutoff at 10 feet, shippers faced a dilemma of either opting for the unpredictability of LTL services or resorting to shipping with partially filled truckloads to comply with strict delivery timelines.

To avoid shipping partially empty loads, 22% of TL shippers waited to ship until they could fill an entire truckload. Meanwhile, 16% of shippers also booked truckloads “often” or “very often” because they weren’t sure another option would deliver the freight on schedule, and 25.5% “often booked” truckloads because they were unsure another mode or option could deliver freight without damage.

“Historically, the U.S. truckload market has been locked into a binary concept of ‘full’ or ’empty’ when it comes to trailer capacity,” said Chris Pickett, COO, at Flock Freight. “We are challenging both shippers and carriers alike to rethink this.”

With 43% of truckloads moving only partially full, there’s a massive opportunity for businesses to maximize trailer utilization and reduce overall transportation spend, said Pickett, like a shared truckload solution.

While less than truckload shippers may be drawn in by the cost-efficiency, surprise fees and handling risks can cause higher overall costs.

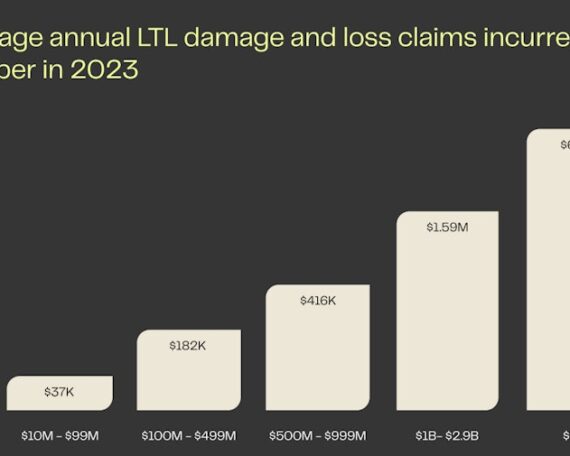

An ongoing challenge the research highlights are the hidden costs of LTL shipping, with the average enterprise shipper incurring up to $6.3 million annually in damage and loss claims. The average LTL damage rate was reported at 1.94%, with larger enterprises facing higher expenses due to their larger shipment sizes.

Minimizing damage claims enhances customer retention, with one respondent saying, “The likelihood of losing to competitors is reduced by minimizing damage and delays.”

Additionally, there’s other surprise fees, including unexpected accessorial fees such as reweighing, reclassing or overlength fees, that LTL shipments can accumulate. These unexpected fees, which are challenging to budget for, impact automotive businesses the most, averaging $548 per shipment. With enterprise companies the size of $3 billion, this added up to $2.3 million in accessorial fees in 2023.

The study also depicted how shippers are investing in tracking technologies to comply to strict delivery schedules or risk incurring OTIF penalties. With 58% of respondents planning to invest in tracking tech platforms to avoid delays. A survey respondent noted, “Tracking and visibility are top priority so that we can monitor the movement of materials in real-time throughout the supply chain while tracking inventory levels, shipments in transit, and enhancing our logistics capabilities.”

This aligns with the sentiments of several large fleets, such as Landstar and J.B. Hunt Transport Services, which noted in their first quarterly earnings reports priorities to invest in technology.

Simultaneously, the adoption of new digital platforms to support online load bookings have raised concerns on the risk of fraud and theft.

[Related: With a potential increase of cargo theft amid Memorial Day, experts offer mitigation insights]

This was a concern for bigger fleets, too. In an earnings call to analysts, Brad Hicks, president of highway services and executive vice president of people at J.B. Hunt, said, “While technology is a foundational pillar for us, it has opened new avenues for bad actors to engage in sophisticated strategic theft given these organized groups’ access to thousands of loads through our platform.”

Data showed that 89% of shippers were impacted by theft and fraud in 2023, causing a ripple effect, including reduced earnings, unexpected fines and fees, increased complaints, and customer dissatisfaction.

Among those affected by theft and fraud, 13% said they were unprepared, with one survey respondent pointing out, “In 2023, I wasn’t prepared for… significant disruptions to shipping operations and business activities because of the theft of the goods and products.”