ISEE and Tico automating yard trailer movements

ISEE and Tico have announced a partnership that has deployed a fully autonomous terminal tractor to a Fortune 100 logistics provider. ISEE says it’s the first company to achieve fully […]

ISEE and Tico have announced a partnership that has deployed a fully autonomous terminal tractor to a Fortune 100 logistics provider. ISEE says it’s the first company to achieve fully […]

Penske Transportation Solutions has once again received confirmation of its excellence in the recruitment and retention of veterans by being named a 2025 Military-Friendly Gold Employer. Penske received this designation from VIQTORY, a veteran-owned business and the publisher of the G.I. Jobs and Military Spouses publications.

“Veterans excel at many different types of roles across our organization,” stated Jennifer Sockel, Penske executive vice president of talent and enterprise services. “Penske recognizes that veterans have a sense of teamwork, dedication, and commitment that enhances the company’s workforce. We make a concerted effort to recognize and value their contributions to our success as a leading transportation services provider.”

Institutions earning the Military-Friendly Employers designation were evaluated using both public data sources and responses from a proprietary survey.

Final ratings were determined by combining an organization’s survey score with an assessment of the organization’s ability to meet thresholds for recruitment, new hire retention, employee turnover, and promotion and advancement.

Kayla Lopez, senior director of partnerships at Military-Friendly noted: “We salute these exemplary employers who raise the bar and understand that hiring military personnel is not merely an act of goodwill but a testament to a standard that truly embodies sound business wisdom.”

Please click here for a listing of Penske career opportunities for veterans.

By “Move Ahead” Staff

Ocean rejection rates spike as bookings fall

(Chart: SONAR Container Atlas)

Much of the focus the past several days has been on the drop in ocean bookings from China to the U.S., and with good reason. The SONAR Ocean Booking Volume Index from China to the U.S. is now down about 50% year over year, roughly in line with the reported average from ocean carriers and other data sources. A FreightWaves article published last week goes into detail.

(Chart: SONAR Container Atlas)

A related dataset that has moved sharply in recent days is the Ocean TEU Rejection Index from China to the U.S. It’s now up over 20%, which only has historical precedent during the early days of COVID and the rush surrounding major Chinese holidays. To mitigate the impact that falling demand will have on rates, carriers are employing a range of tactics including deploying smaller vessels, blanking sailings and suspending entire service loops (regular routings that call on a set sequence of ports). In fact, according to Flexport, ocean carriers are reducing capacity from China to the U.S. at a rate faster than the early days of COVID. Summer goods are already on shelves or in warehouses, but the sharp reduction in capacity presents risks to goods availability in the fall. Those strategies are helping to keep container rates relatively stable.

Transportation earnings season has largely been a flurry of cuts to expectations

Here is a sample of the earnings writeups on FreightWaves.com:

Tender rejection rates depressed in many multimodal hub cities

The Long-haul outbound tender rejection rate is shown for Los Angeles (yellow), Newark, New Jersey, (green), Chicago (red), Atlanta (peach) and the U.S. as a whole (white). (Chart: SONAR)

Domestic intermodal companies and Class I railroads have recently described how the competitiveness with truckload is keeping a lid on intermodal rates despite intermodal volume that grew in the mid-single digits in the first quarter. Looking at long-haul tender rejection rates, which limits the datasets to lengths of haul exceeding 800 miles to exclude many noncompetitive loads is one way to monitor the competitive dynamic between truckload and intermodal.

Average long-haul tender rejection rates typically exceed rejection rates for other lengths of haul, as they do currently. (The national long-haul tender rejection rate is 5.55% versus a national tender rejection rate of 4.95% for all lengths of haul.) What also stands out is that long-haul tender rejection rates are significantly below the national tender rejection rate for many locations that serve as major intermodal hubs. Most notable is the depressed long-haul Los Angeles and Atlanta outbound tender rejection rates of just 2.5% and 2.9%, respectively. Those rates suggest that carriers are accepting nearly all loads available on the contract market and imply that shippers may be able to move freight at lower rates on the truckload spot market. One example is the Atlanta-to-Chicago lane – SONAR Market Dashboard shows a highway spot rate of just $1.35 per mile, well below the highway contract rate of $2.29 and even below the intermodal contract rate in SONAR of $1.48. (All rates include fuel surcharges.)

The Stockout on final mile at Werner

(Image: FWTV)

On Monday’s The Stockout, FreightWaves’ retail and CPG show, Grace Sharkey and I discussed the impacts of tariffs and Sharkey interviewed Meg Meurer, vice president of dedicated and final-mile sales at Werner Enterprises.

As Meurer explained, Werner has built an extensive training program to ensure that final-mile customers are getting white-glove treatment, whether that involves the delivery of furniture or appliances at a residence or specialized equipment at a hospital or auto assembly plant. Staff is trained on installation, assembly and disassembly. The training involves role-playing and ride-alongs to help drivers deal with unique situations, which could include an unruly dog or a customer with disabilities.

Monday’s show can be viewed on The Stockout YouTube channel.

To subscribe to The Stockout, FreightWaves’ CPG and retail newsletter, click here.

The post Ocean carriers blank sailings as bookings drop appeared first on FreightWaves.

On Episode 830 of WHAT THE TRUCK?!?, Dooner is back from Chicago, where he got to see that state of freight on the world’s most powerful visibility platform: project44. With ocean booking cancellations up bigly on the East and West coasts, when will trucking feel the pain?

Did you know that if you export or destroy goods that you’ve paid tariffs on, you can claim 99% of your duties back? We’ll meet Caspian CEO and co-founder Justin Sherlock to talk about his AI-driven duty drawback program.

Drones are taking off as Walmart expands aerial package drop-offs to 1.8 million households in the Dallas-Fort Worth area. James McDanolds at Sonoran Desert Institute has dedicated his career to working on drones. We’ll find out if 2025 is the year drone delivery goes mainstream.

Olivia deMars is a high school student in Massachusetts. Today we’ll find out how Gen Alpha views the tariff situation.

Catch new shows live at noon EDT Mondays, Wednesdays and Fridays on FreightWaves LinkedIn, Facebook, X or YouTube, or on demand by looking up WHAT THE TRUCK?!? on your favorite podcast player and at 5 p.m. Eastern on SiriusXM’s Road Dog Trucking Channel 146.

Subscribe to the WTT newsletter

The post AI for duty drawback: Get back 99% of what you pay in tariffs; Walmart’s drones | WHAT THE TRUCK?!? appeared first on FreightWaves.

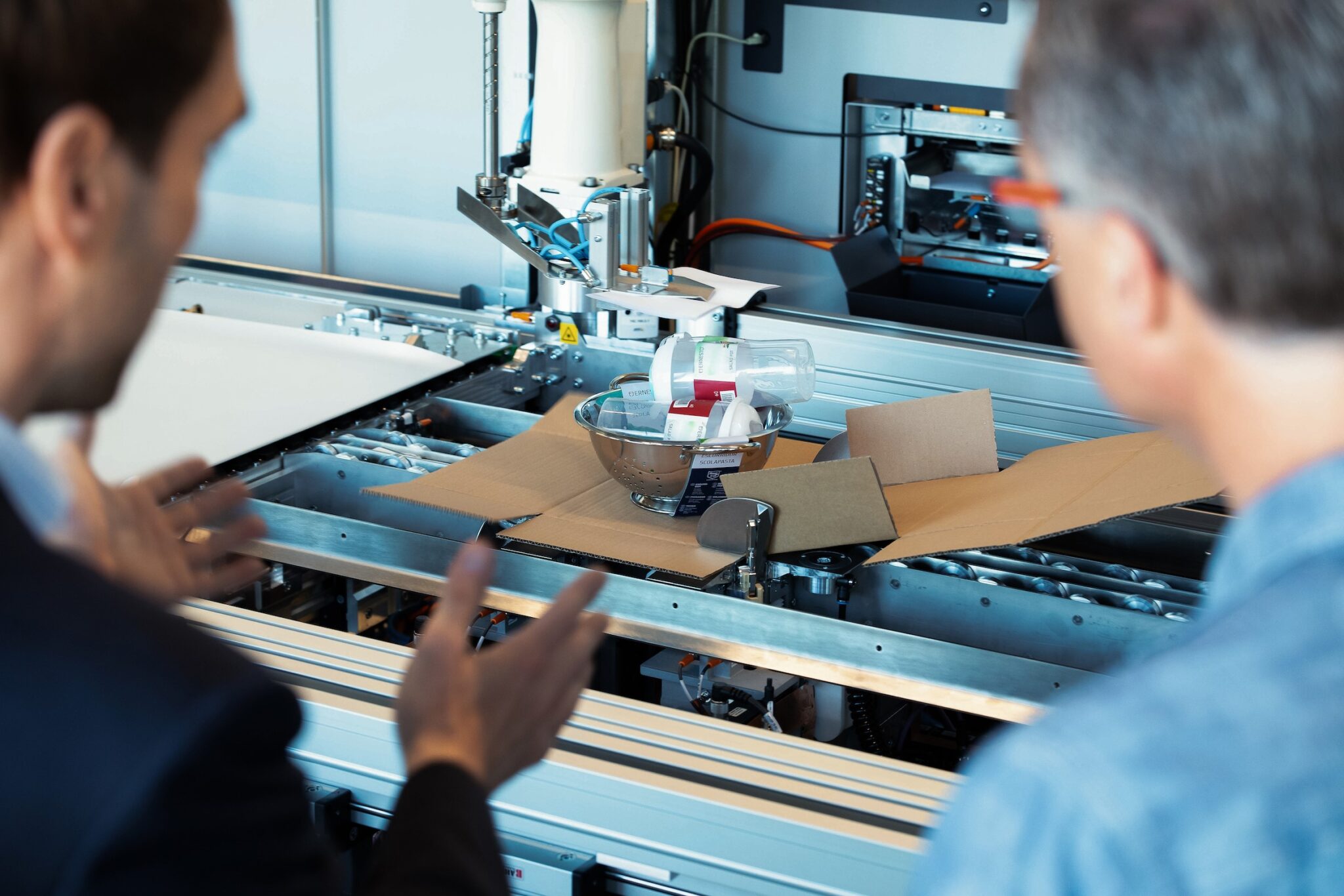

Packsize, supplier of sustainable, right-sized, on-demand packaging, has announced the company’s completed agreement to acquire Sparck Technologies, a European-based manufacturer of high-throughput, fit-to-size, automated packaging solutions.

The acquisition marks a significant milestone in Packsize’s growth strategy and strengthens its position in the automated packaging industry. By combining Packsize’s technology and service model with Sparck’s best-in-class box last and lid and tray solutions, the company will now provide the industry’s most comprehensive portfolio of solutions to meet evolving customer needs.

“Sparck has long been recognized for its innovation, reliability, and strong commitment to sustainability – values that align perfectly with our own,” said David Lockwood, CEO of Packsize. “Together, our complementary technologies create a more complete product offering for our customers. This acquisition brings us one step closer to realizing our mission of Smart Packaging for a Healthy Planet by accelerating our ability to deliver more sustainable, right-sized packaging solutions to customers around the world.”

“Bringing Sparck into the Packsize team is a strategic move that expands what we can offer our customers – especially in high-volume, high-efficiency environments,” said Brian Reinhart, Chief Revenue Officer at Packsize. “Sparck’s box last and lid and tray solutions allow us to solve a broader range of packaging challenges. This isn’t just about growth – it’s about delivering smarter, more sustainable automation at scale.”

Sparck Technologies, headquartered in Drachten, Netherlands, is best known for its advanced CVP Impack and CVP Everest systems – automated solutions that optimize throughput and reduce waste by creating fit-to-size boxes at scale. “This acquisition is a perfect match,” said Kees Oosting, CEO of Sparck. “It allows us to bring more value to our customers faster and at a greater scale than either company could achieve alone.”

Standard Investment has worked closely with Sparck to execute a successful transformation of the activities in Drachten. Originally part of French-listed multinational Quadient, Standard Investment segmented Sparck to become a standalone company in 2021.

Herbert Schilperoord, Partner at Standard Investment, said: “We are very proud of what the Sparck team has achieved with the involvement of Standard Investment, pivoting the organization to a cutting-edge technology leader in the fit-to-size packaging area. We’re confident that together, Packsize and Sparck will continue a strong growth trajectory, delivering fit-to-size technology to global tier 1 customers.”

The post Packsize to Acquire Sparck Technologies appeared first on Logistics Business.

Volvo Trucks North America is seeking certification for a new engine that meets the California Air Resources Board’s (CARB) 2024 Omnibus emissions standards. Once certified, the engine will be available […]

Freightos Enterprise unifies market intelligence, tender management, and shipment operations into one solution, enhancing logistics efficiency for large import-export businesses.

Blog

Put the Data in Data-Backed Decision Making

Freightos Terminal helps tens of thousands of freight pros stay informed across all their ports and lanes

The post Introducing Freightos Enterprise: End-to-End Procurement, Benchmarking, and Management appeared first on Freightos.

UPS continues its expansion in the health care industry, most recently with plans to acquire Andlauer Healthcare Group, a Canada-based cold chain logistics company. The acquisition was a casual $1.6 billion all-cash transaction. It is part of UPS’ plan to double revenue in health care logistics to $20 billion by 2026.

In a news release, Kate Gutmann, president of international, health care and supply chain solutions for UPS, said: “Next-generation treatments are driving more complexity than ever, expanding the needs of healthcare customers and increasing demand for the integrated, end-to-end cold chain solutions UPS Healthcare provides around the world.”

The acquisition is expected to be finalized in the back half of 2025 but is still subject to approval by AHG’s shareholders and regulators. The buyout for shareholders is CA$55 (about $40) per share, roughly a 30% premium to closing stock prices on the day the deal was announced.

Eric Kulisch writes for FreightWaves: “UPS Healthcare has more than 19.2 million square feet of pharma-certified warehouse space under management, including extensive temperature-controlled facilities. Services include inventory management, cold chain packaging and shipping, storage and fulfillment of medical devices, and lab and clinical trial logistics.”

Jacksonville, Florida, is turning up the chill, in the best way possible. FreezPak Logistics, a specialist in the temperature-controlled logistics space, is expanding its national footprint with a brand-new, state-of-the-art facility near the Port of Jacksonville.

The new facility spans 272,000 square feet and offers capacity for more than 50,000 pallet positions, across both frozen and cooler zones. That’s a serious amount of space dedicated to keeping things cool in the Southeast, a region where demand for cold storage is rising fast.

With 32 dock doors, the Jacksonville facility is built for efficiency and scalability. This move is part of a bigger expansion strategy. Jacksonville follows on the heels of FreezPak’s recent development in Los Angeles, and it’s just the beginning. Another new facility is already on the horizon in Norfolk, Virginia.

Frozen pizza is not always top of mind as an economic indicator. Much like the Lipstick Index, an informal economic theory that when consumers perceive that a recession is looming, sales for “affordable luxury” items such as lipstick increase. Turns out frozen pizza is a barometer for that as well. While these different indicators may not be “economically proven,” they are related to an extent.

In recent weeks the sale of higher-priced frozen pizzas has increased. The rise of frozen pizza, specifically the higher-end variety, is a sign of shifting consumer habits. According to market research firm IBISWorld, the U.S. frozen pizza industry generated $6.5 billion in annual revenue in 2024 and remains well above its pre-pandemic level.

Craig Zawada, chief visionary officer at price optimization firm Pros Holdings, clarified that while “It may seem paradoxical for consumers to choose high-priced frozen pizzas during a downturn, it’s a trade-off as they substitute dining out with eating at home. This happens every sort of downturn in the economy.”

As consumers put a pause on luxury vacations and big purchases, the smaller splurges or “little treats” are more commonplace. If going out to dinner isn’t in the budget, a $12 frozen pizza is a much easier cost to swallow.

This week’s market under a microscope heads south to Dallas. Capacity is loosening significantly in Dallas as both reefer outbound tender volumes and reefer outbound tender rejections plummet. Reefer outbound tender volumes have dropped 36.65% week over week. During the same period, reefer tender rejections dropped 568 basis points to 5.88%.

Both reefer volumes and reefer rejections in Dallas are at the lowest level thus far this year. This is a strong indication of a weakening market for spot rates and demand for capacity. These trends are atypical for this market and this time of the year, meaning historical rates and trends won’t be as reliable for pricing spot rates on the decline. The one good thing about the falling capacity is that shippers can expect stronger contract carrier compliance.

Is SONAR for you? Check it out with a demo!

Bar Tender by Wingstop: The first bar dedicated to chicken tenders

Synear Foods USA brings authentic Chinese dumplings to Sam’s Club stores nationwide

Demand for cold storage projected to stay hot

Birds Eye goes green: Solar-powered refrigerated trailers set to hit the roads

Maine’s new cold storage facility is at the center of a legal battle over millions in unpaid bills

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.

The post Running on Ice: UPS makes another play in the health care space appeared first on FreightWaves.

Diamondback Energy, the largest independent oil producer in the Permian Basin, says production has likely peaked in America’s shale fields and will decline in the months ahead.